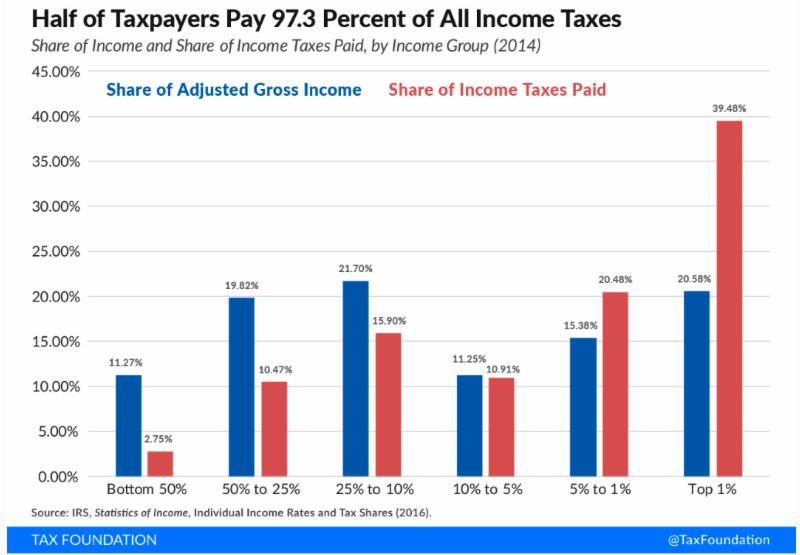

The Tax Foundation has released a study examining the federal income tax burden. According to IRS data and the Tax Foundation's analysis, Americans in 2014 paid $1.37 trillion in individual income taxes to the federal government -- an 11.5% increase from taxes paid the previous year. In 2014, the top 50% of taxpayers paid 97.3% of all individual income taxes; the bottom 50% paid the remaining 2.7%. The top 1% of taxpayers paid a greater share of individual income taxes (39.5% or $543 billion) than the bottom 90% combined (29.1% or $400 billion). The Foundation notes that the top 1% of taxpayers earned 20.58% of all AGI but paid nearly 40% of all income taxes at a 27.1% tax rate -- more than seven times higher than the rate paid by the bottom 50% of taxpayers (3.5%).